How will COVID-19 affect the market…and what should I do?

Be informed, and then take these specific steps to help your neighbors.

- 4 min read

- April 2, 2020

Be informed, and then take these specific steps to help your neighbors.

Two weeks into Governor Inslee’s “stay at home” order, and most of us have more questions than answers regarding coronavirus. Besides the obvious medical concerns, there are equally pressing economic questions. Among them:

Two weeks into Governor Inslee’s “stay at home” order, and most of us have more questions than answers regarding coronavirus. Besides the obvious medical concerns, there are equally pressing economic questions. Among them:

There will undoubtedly be a recession. Recessions happen on average every 5-10 years, and we were long due for one anyway as a normal part of the business cycle. However, the recession of 2020 will be significantly different from 2008 – especially when it comes to real estate.

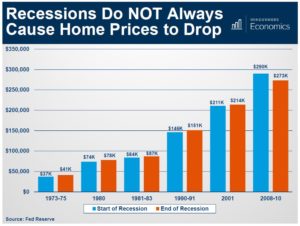

For starters, home prices will almost certainly not drop. Out of the last six recessions, only one (2008) saw a net decrease in home value. And that was primarily because dishonest lending practices and Wall Street speculation created that situation. Lenders are significantly more regulated now under today’s rules. And other economic indicators such as unemployment, mortgage indebtedness, and historically low interest rates were all very robust prior to the COVID-19 pandemic. Finally, our region’s chronic shortage of housing inventory continues, and if anything will intensify during the health emergency. Scarcity tends to drive prices upward.

For starters, home prices will almost certainly not drop. Out of the last six recessions, only one (2008) saw a net decrease in home value. And that was primarily because dishonest lending practices and Wall Street speculation created that situation. Lenders are significantly more regulated now under today’s rules. And other economic indicators such as unemployment, mortgage indebtedness, and historically low interest rates were all very robust prior to the COVID-19 pandemic. Finally, our region’s chronic shortage of housing inventory continues, and if anything will intensify during the health emergency. Scarcity tends to drive prices upward.

No one can predict the future, but these indicators point to a recession that will most likely stabilize or slow the rise in property values. Assuming we can largely resolve COVID-19 by the end of the year – the economy as a whole will probably begin a slow track towards stabilization and recovery.

No one can predict the future, but these indicators point to a recession that will most likely stabilize or slow the rise in property values. Assuming we can largely resolve COVID-19 by the end of the year – the economy as a whole will probably begin a slow track towards stabilization and recovery.

Of course, these facts are hardly comforting for people out of work with bills to pay. The economy, after all, is human beings. The single biggest X factor in this crisis is the role of government. Will other states follow science-based policy that medical experts say is finally starting to work? Will the federal government provide meaningful aid to the hardest-hit communities? Will Congress provide more than a paltry one-time $1,200, which barely even covers one month’s rent in a market like ours?

The jury is out on these things. But in the meantime, there are many direct steps you can take to protect yourselves and the people around you:

1. Follow expert medical advice. This is common sense. Stay home and limit your contact with others, if your economic situation allows for it. Wash your hands like crazy. This stuff does work.

2. Get tested if you are experiencing symptoms. Community Health Care is now offering free testing for anyone who is experiencing COVID symptoms, and is either in a high-risk group and/or works in an impacted line of work. Click on the link to see if any of that applies to you. Refer your friends or family if they fall under those categories.

3. Advocate politically for your neighbors. It’s not enough to pause evictions and foreclosures. Those bills will still be due at the end of the pause, and for millions of people out of work, that could lead to a catastrophic wave of foreclosures and evictions (and homelessness) if not sufficiently addressed. That’s why our state and nation should follow Italy’s and New York’s lead and actually suspend mortgage and rent payments for a meaningful period of time, like 90 days. This would not only allow residents and landlords a much-needed respite, but would also spare the economy a tremendous blow. Contact Governor Inslee and your legislators to urge them to call a special session, and address this urgent issue immediately.

We will weather the storm. The real question is whether we can fight unprecedented danger with historical courage.